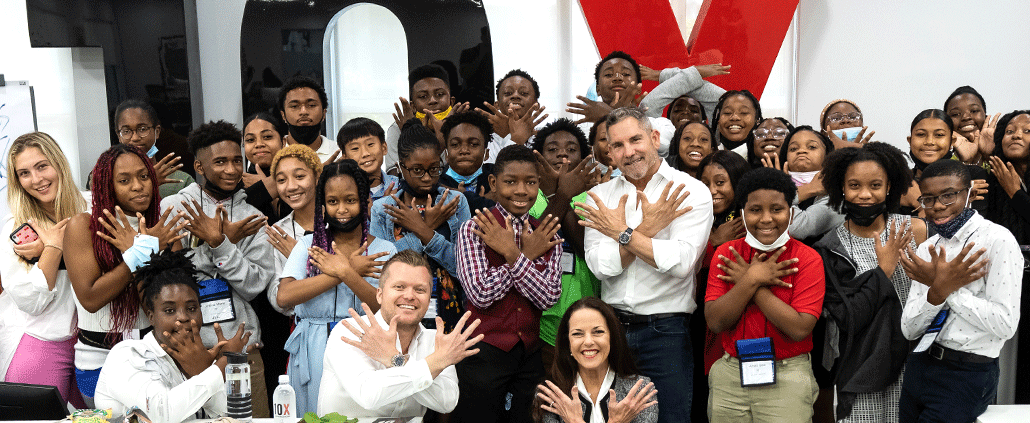

Thursday, June 30th, the Overtown Youth Center experienced a 10X day at our team’s headquarters in Aventura, Florida. Hosted by the Grant Cardone Foundation, the event included a complete office tour, inspirational presentations from our top executives, and must-know insights from 10X Kids University.

In honor of Women’s History Month, Elena Cardone empowers young women with a mentoring workshop.

This July, the Grant Cardone Foundation partnered with Breakthrough Miami to hold the first-ever 10X Career Day. We invited a group of Miami-Dade County Public School eighth-graders to 10X Headquarters. Our goal was to motivate and help them realize you can do anything you put your mind to.